At least 27 Ontario developers have gone into receivership this year, a higher number than the province has seen in years. It’s an alarming spike that experts sayÌýputs hundreds of housing units in jeopardy and puts preconstruction buyers in limbo — with their life savings on the line.

“The new-build space is utterly dead,” said lawyer Mark Morris, with real estate firm .Ìý

According to Insolvency Insider, a database that tracks the largest insolvencies in Canada, 18 receivership filings were reported for Ontario developers in 2023, with 16 filings in 2022, 19 filings in 2021 and 15 in 2020 — numbersÌýbased onÌý“reporting on larger court-appointed receiverships,” said Dina Kovacevic, editor at Insolvency Insider. The court orders are available on the receivers’ websites.Ìý

Over the past couple of years cracks in the homebuilding industry have begun to show.ÌýStateView Homes collapsed in the middle of 2023Ìýafter defaulting on hundreds of millions of debt, leaving hundreds of homeowners in the lurch.ÌýMizrahi Developments went into receivership in October 2023,Ìýwith the future of The One — an 85-storey luxury tower at Yonge and Bloor streets — unknown.Ìý

The builder has a track record of “financial mismanagement,” according to the HCRA, which citesÌýan “unexplained shortfall” of $14 million in

The builder has a track record of “financial mismanagement,” according to the HCRA, which citesÌýan “unexplained shortfall” of $14 million in

Experts sayÌýthe trend may continue for years as builders struggle to finish projects due to a volatile economic landscape. Elevated construction and materials costs, labour shortages and high interest rates have devastated projects, with dozens of builders owing multi-millions to their creditors.Ìý

“We’re seeing more developers and builders go into receivership and that number will continue to rise as interest rates remain high, buyers are unable to close, and materials costs are up,” said licensed insolvency trustee Joshua Harris of based in Toronto.

“Buying preconstruction was an exciting business five years ago, but people are holding on for dear life at this point.”Ìý

Consumers left in limbo

Recently, Harris had an unusual case before him. As a licensed insolvency trustee, his job is to help people struggling to repay their debt. In June, one such client came to him, asking to file for bankruptcy, as she was unable to handle her $60,000 debt load.

Harris asked what her assets were and whether she owned any property — as such assets are often sold to help repay debt. She said she had made a deposit on a townhome, but it hadn’t been built yet.Ìý

“We did some digging and found out the developer was in receivership,” Harris said. “It put her in a difficult position.”Ìý

It meantÌýshe couldn’t file for bankruptcy because her asset wasn’t technically an asset that she could sell, as “who would buy something that’s in receivership?” Harris added.

In fact, the client may not even have her agreement to purchase for much longer.

Often, in the receivership process preconstruction buyers end up having their agreement of purchase and sale terminated, said licensed insolvency trustee Bryan A. Tannenbaum, managing director of Restructuring, a firm that has acted as the court-appointed receiver for multiple real estate projects.

Housing projects are often put into receivership when the builder defaults on a loan used to fund the project,ÌýTannenbaum said. The lender can then apply to the courts to put the property into receivership and the receiver, appointed through a court order, then takes possession and control of the property to sell or market the property “as is” or to finish the project and realize the profit and returns for the creditors, he added.Ìý

A new purchaser of the property in receivership will typically ask that the existingÌýagreements of purchase and sale be terminated by court order as those agreements are no longer profitable and the deposits have already been spent by the insolvent builder, Tannenbaum said.Ìý

“In most cases, I’d say 99 per cent of the time, theseÌýagreements of purchase and sale unfortunately get terminated,” he said. “A new purchaser who will take on the project doesn’t want to be responsible for those contracts.”

Tarion anticipates a payout of $90 million to cover lost deposits due to builder failures.

Tarion anticipates a payout of $90 million to cover lost deposits due to builder failures.

Preconstruction residential buyers are then entitled to go to Tarion, Ontario’s consumer protection organization for newly built homes, to receive partial or all of their deposit back depending on if they purchased a condo or freehold homes.Ìý

If a buyer signed a purchase agreement on or after Jan. 1, 2018, homes with a sale price of $600,000 or less have up to $60,000 of their deposit covered. Homes over $600,000 have protection coverage of 10 per cent of the sales price to a maximum of $100,000.

Deposits for condominium purchases are usually held in trust by the builder’s lawyer and must be returned in full without interest. If this does not happen then Tarion will only provide protection up to $20,000.

“Now the new developer could go back to these preconstruction buyers and resell the units, but they’re typically asking for even more money,” Tannenbaum added.

“At the end of the day, the preconstruction buyers in this situation are out of a home. That’s the consequence.”

Delays much-needed supply

Even when a project in receivership gets bought by another developerÌýit doesn’t guarantee the units will be built — sometimes the ownership can change hands several times,Ìýdelaying much-needed housing supply by years, experts say.

OneÌýexample is a 72-townhome projectÌýin Richmond Hill’s Oak Ridges neighbourhood. In 2022,ÌýÌýpurchased the lots at 8, 10, 12, 14, 16 and 18 Bostwick Cres., and 2, 6 and 8 Bond Cres.Ìýfrom Ideal (BC) Developments, which sold townhomes,Ìý.Ìý

BecauseÌýIdeal (BC) Developments was not authorized to build, the project had already been delayed when King took over. Then, not long after, KingÌý, owing $22.5 million to its largest creditor.

The Ìýand overgrown with vegetation, awaiting a new buyer four years after the site was initially bought.

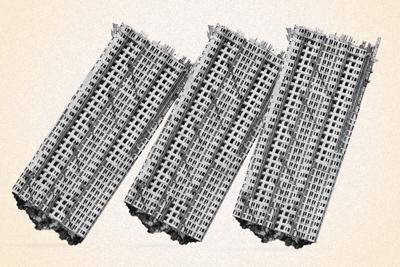

“There’s a major supply gap forming,” said Daniel Foch, a Toronto-based realtor and director of economic research with RARE Real Estate. Not only because projects areÌýtossed around from buyer to buyer, but also because the preconstruction environment is so dire, there’s fewer presales and fewer new builds on the horizon.

According to a report from real estate research firm Urbanation,Ìýthe percentage of pre-construction condos that are pre-sold is at a more than 20-year low of less than 50 per cent. Without at least 70 per cent of presales, a condo project can’t begin construction, so the reduction in sales is dramatically slowing the supply pipeline.

If buyers continue to sell condos below contract value in assignment sales, the sell-off could lower valuations for entire buildings, experts warn

If buyers continue to sell condos below contract value in assignment sales, the sell-off could lower valuations for entire buildings, experts warn

And more buyers are simply walking away from their deposits unable to close on the property as interest rates are much higher than when they agreed to purchase the homes a few years ago, said real estate lawyer Morris, adding thatÌýassignment sales —Ìýa legal transaction in which the original pre-construction buyer transfers the rights and obligations of the purchase agreement to another buyerÌý—Ìýhave fewer takers.Ìý

The current environment for preconstruction shows that developers under financial stress will have difficulty finding buyers as consumer confidence dims, leaving them more vulnerable to the receivership process.Ìý

“In three to five years the reduction in highrise construction is pretty catastrophic,” Foch said.Ìý

The future of new builds

But even once the dust settles, we’re unlikely to see a return to normalcy any time soon.

The most likely outcome for struggling builders is an increase in mergers and acquisitions; sites will be absorbed by bigger players in the development space, said Foch.Ìý

“We tend to see a surge of mergers and acquisitions in recessions,” he said. “Bigger developers swoop in and offer to bail out the smaller developer and get in on creatively structured deals.”Ìý

Morris said the preconstruction market won’t see growth for another five to seven years, as “we lost half a decade to a decade of capital appreciation.”Ìý

“Pricing divorced itself from Canadian incomes, and it’s so far off course, prices must fall significantly for people to buy in again,” he said.Ìý

To join the conversation set a first and last name in your user profile.

Sign in or register for free to join the Conversation